Knowing what you get from the beginning

For Upfront Interest on fixed deposit: Interest earned on your fixed deposit/high yield, will be paid to your current or savings account with the Bank the next day after applying. Rollover, Top-up, and Early Liquidation options are not available. Fixed Term Deposits may occasionally be unavailable in certain currencies due to public holidays. Interest rates are quoted for indication purposes only and are subject to variation. AER (Annual Equivalent Rate): This is a notional interest rate which illustrates what the gross rate would be if interest were paid and compounded each year.

Make your money grow in a short time! The FIXED TERM DEPOSIT is your easy, transparent and quick way to accelerate your savings.

If you know what you have and what need, just decide by yourself how long you wish to save or how much profit you wish to generate. Maturity reaches from 3 months to 3 years. You can open your FIXED TERM DEPOSIT account in local or foreign currency and track your savings balance online.

Knowing what you get from the beginning

Fixed Term Deposit Lock away money from overnight to 3 years and get a fixed interest rate on your savings Key features and benefits The interest rate is fixed so it won't change during the term. With our Term Deposits, you have the security of locking in a fixed rate of return, giving you greater peace of mind. Choose from a range of terms You can choose from a range of terms to suit your needs. Anything from 1 month to 5 years.

Make your money grow in a short time! The FIXED TERM DEPOSIT is your easy, transparent and quick way to accelerate your savings.

Fixed Term Deposit Definition

If you know what you have and what need, just decide by yourself how long you wish to save or how much profit you wish to generate. Maturity reaches from 3 months to 3 years. You can open your FIXED TERM DEPOSIT account in local or foreign currency and track your savings balance online.

FEATURES AND REQUIREMENTS:

| Maturity: | 3 months, 6 months, 1 year, 2 years or 3 years |

| Interest rate: | Contact us for rates |

| Minimum opening balance: | USD1,000 |

| Depositor age requirement: | 18 years or above |

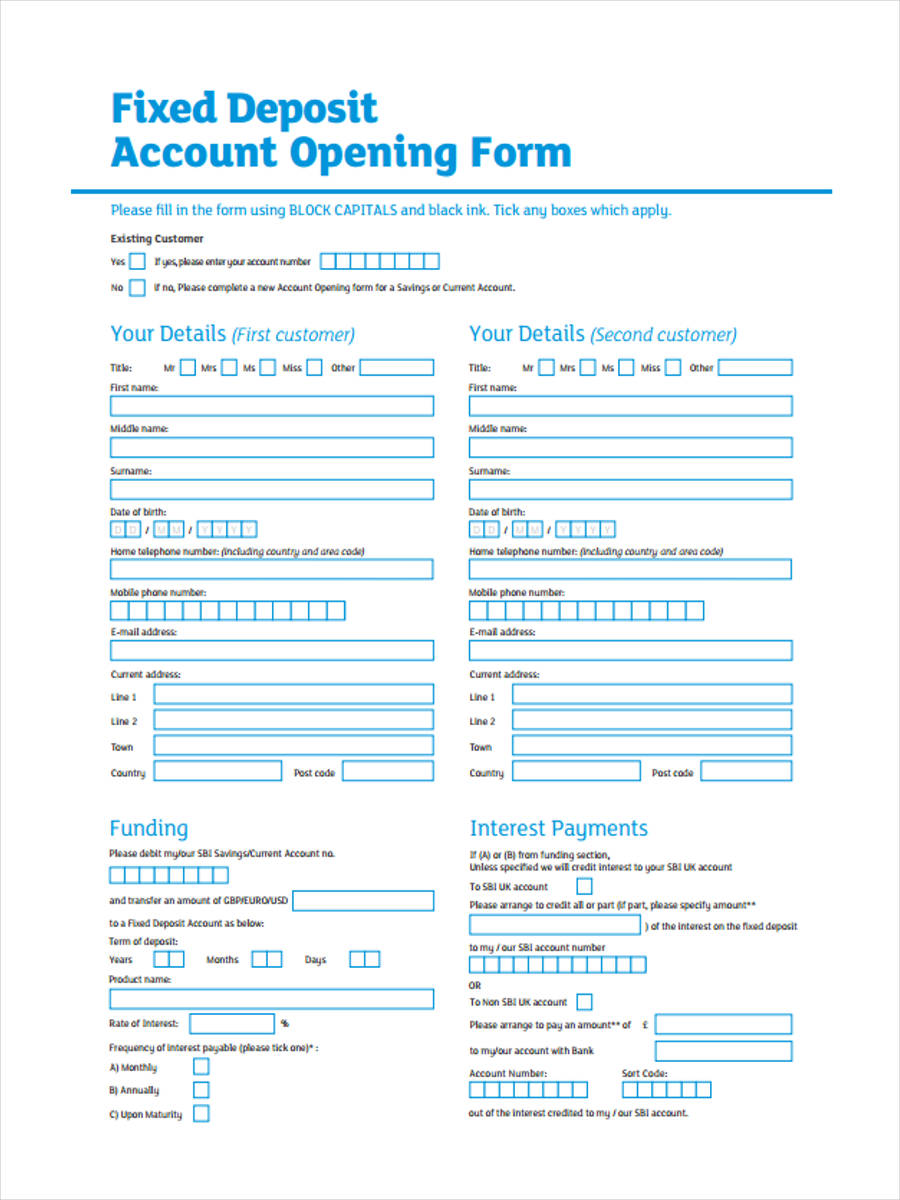

To open a FIXED TERM DEPOSIT account, an identification document of the account holder is required.

For further information, contact one of BRED’s relationship managers.

Or download our Terms & Conditions

Bank Term Deposit Interest Rates

Contact us about this product or to set up an appointment